Hermes Trade Line

Product Overview

What is the Hermes Trade Line?

The Hermes Trade Line is a fully secured revolving term loan. It helps SMEs grow by converting their accounts payable to their trade suppliers into 3 or 4 equal monthly instalments.

What is the security?

What is the funding process?

How is this priced and charged?

What are the repayments?

How many drawdowns a month?

No interest?

Can this facility stand alone?

What is the Hermes Trade Line?

The Hermes Trade Line is a fully secured revolving term loan. It helps SMEs grow by converting their accounts payable to their trade suppliers into 3 or 4 equal monthly instalments.

What is the security?

What is the funding process?

How is this priced and charged?

What are the repayments?

How many drawdowns a month?

No interest?

Can this facility stand alone?

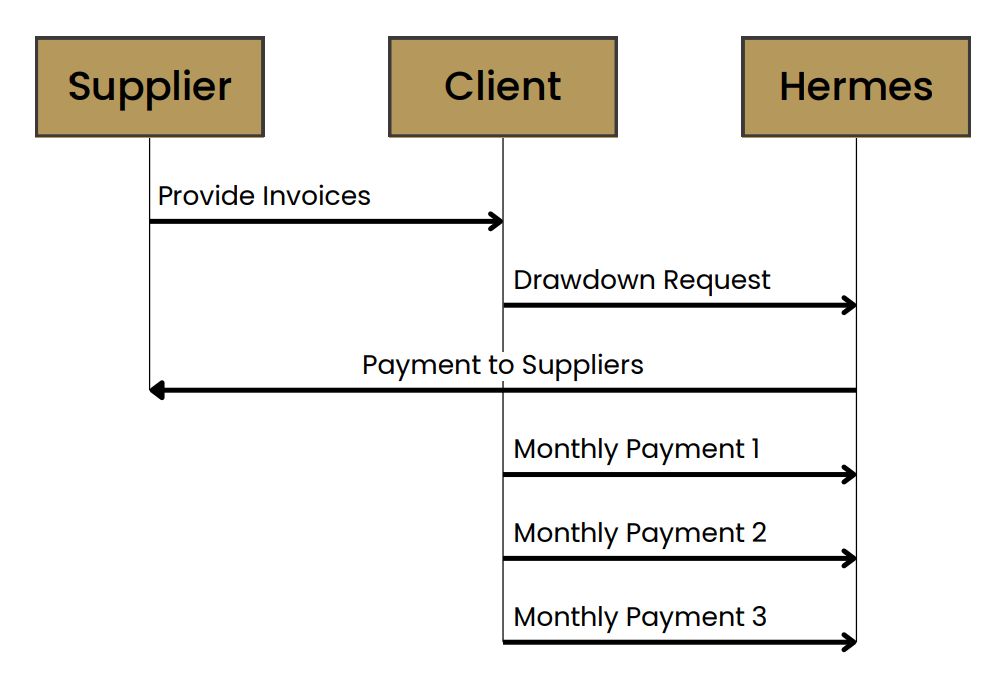

Drawdown Process

Payment calculation:

Monthly Payments = (Drawdown Amount + Drawdown Fee) / Number

of monthly payments.

For example, for a $100 drawdown incurring a 5% fee for three months:

Payments = ($100 + $5) / 3 = $35 per month

Eligibility

Types of Acceptable Security

Determined during due diligence based on the equipment or property value.

Supplier and Invoice Restrictions

Trade suppliers only (suppliers in the normal course of business).

Why the Hermes Trade Line?

Flexible Credit Approach

Our experienced team and lean structure provide best-in-class service.

Cash Flow Management

Helps clients stay current with supplier terms, facilitating ongoing supplies and potential early payment discounts.

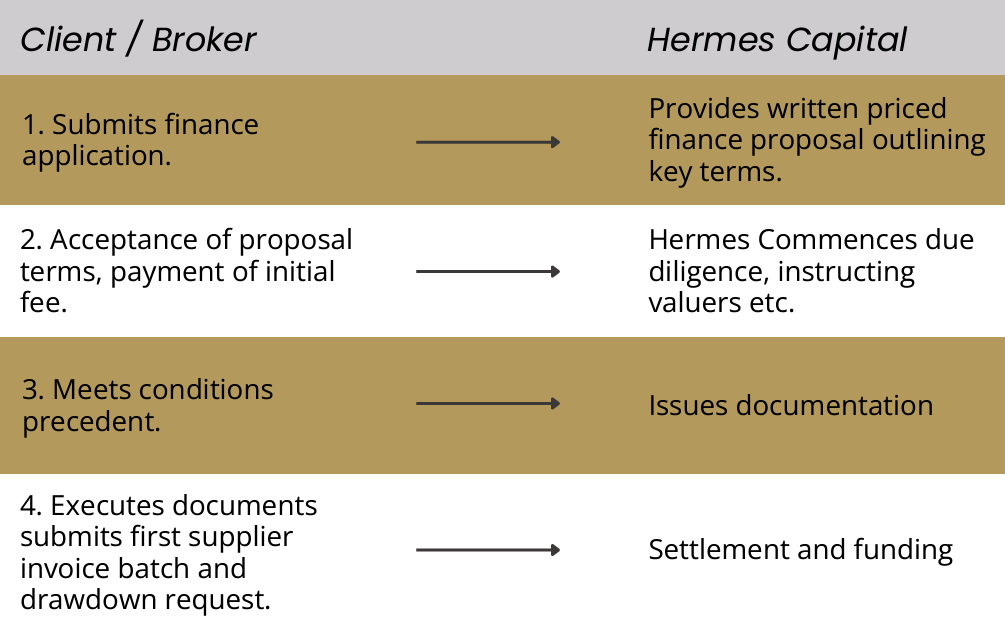

Process and Timeline

Approval Time

Within 48 hours of receiving all requisite information.

Facility establishment process

Case Study

A furniture manufacturer found themselves on “stop credit” with a number of key suppliers after a working capital issue severely constrained their cash flow. The owner had stepped away from the business and the new manager allowed margins to collapse. The owner was able to remedy this issue but needed supplies to fulfil new orders and restore their original business growth trajectory. Their suppliers refused to continue supply until their accounts were brought back into order.

The client’s broker introduced a Hermes Tradeline. Once the facility was approved and established, the client presented a batch of supplier invoices which Hermes promptly paid. The suppliers released the withheld stock and the business was able to resume manufacturing and fulfill the profitable orders it had on hand. It repaid the initial drawdown over four equal repayments and is now able to re-draw on the facility again to import lines of products from China to complement its own manufactured goods to expand its business further.